KEYTAKEAWAYS

Just when the world's major stock markets are facing headwinds, the Indian stock market has repeatedly set new highs and has become the most outstanding market in recent times. Many investors are optimistic that this rising star in Asia will soon become the next China, and even challenge the "world factory."

CONTENT

Introduction to Different Types of ETFs in India

Exchange-Traded Funds (ETFs) have gained immense popularity in India as a convenient and diversified investment option. Let’s take a closer look at the different types of ETFs available in the Indian market.

- Equity ETFs:

Equity ETFs in India track the performance of various equity indices like Nifty 50, Nifty Midcap 150, sectoral indices, or thematic indices. These ETFs offer investors exposure to a diversified portfolio of stocks, providing opportunities for long-term capital appreciation.

- Gold ETFs:

Gold ETFs allow investors to invest in gold without physically owning the metal. They track the price of gold and provide a convenient and cost-effective way to invest in this precious metal. Gold ETFs are popular among investors seeking to diversify their portfolios and hedge against inflation.

- Debt ETFs:

Debt ETFs track the performance of debt securities such as government bonds, corporate bonds, or money market instruments. These ETFs provide investors with an avenue to invest in fixed-income assets and generate regular income. Debt ETFs offer a lower risk investment option compared to equity-based ETFs.

- International ETFs:

International ETFs enable investors to gain exposure to foreign markets and global investment opportunities. These ETFs track the performance of indices from international markets and provide diversification beyond the Indian market. International ETFs can be an attractive option for investors looking to diversify their portfolios geographically.

Top 5 India ETFs

- Nippon India Index Fund S&P BSE Sensex

- HDFC Index S&P BSE Sensex

- Bandhan Nifty 50 Index Fund

- UTI Nifty 50 Index Fund

- Tata Nifty 50 Index Fund

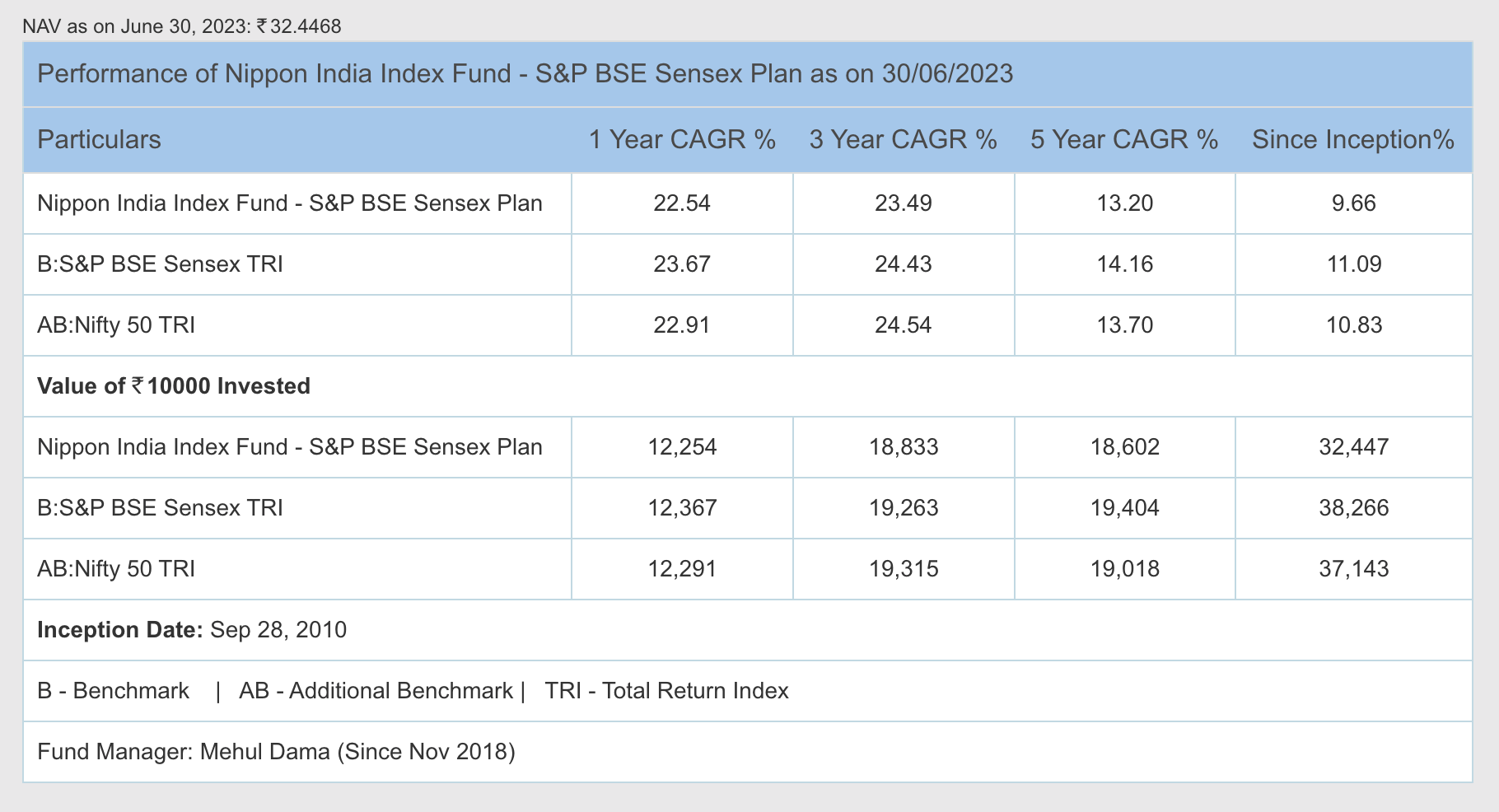

#1. Nippon India Index Fund S&P BSE Sensex

- 10-year-old medium-sized fund

- AUM of ₹477 Crores as of 17/07/2023

- Expense ratio of 0.15%

- 1-year returns of 24.99%

- Average annual returns of 13.19%

- Majority investments in Financial, Technology, Energy, Consumer Staples, and Automobile sectors

- Top holdings: Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Housing Development Finance Corporation Ltd., Infosys Ltd.

#2. HDFC Index S&P BSE Sensex

- 10-year-old medium-sized fund

- AUM of ₹5,071 Crores as of 17/07/2023

- Expense ratio of 0.2%

- 1-year returns of 24.99%

- Average annual returns of 13.45%

- Majority investments in Financial, Technology, Energy, Consumer Staples, and Automobile sectors

- Top holdings: Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Housing Development Finance Corporation Ltd., Infosys Ltd.

#3. Bandhan Nifty 50 Index Fund

- 10-year-old medium-sized fund

- AUM of ₹808 Crores as of 17/07/2023

- Expense ratio of 0.1%

- 1-year returns of 23.74%

- Average annual returns of 13.05%

- Majority investments in Financial, Energy, Technology, Consumer Staples, and Automobile sectors

- Top holdings: Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Housing Development Finance Corporation Ltd., Infosys Ltd.